Keeping the Battleship Together – Investing in Companies in Distress

The coronavirus pandemic has resulted in many New Zealand companies finding themselves in distress. In such difficult times, distressed investing can be the vital lifeline that keeps these businesses afloat. However, for an investor distressed investing comes with risks and opportunities.

To understand what distressed investing is and how it works, see Part 1.

It’s Risky

Investing in companies in distress is inherently risky. There is always the possibility that an investor could lose their entire investment. These risks increase when it is difficult to get information on the true state of the business. Significant resources and expertise are also required to correctly assess the value and potential of your investment into a distressed company. Another point to keep in mind is that distressed investing often involves large sums of money and can be a long process. For example, if the company’s entire industry is failing, or if it is selling goods/services that no one wants, the company will not become viable overnight and the investor will not be seeing returns anytime soon. Furthermore, the equity or debt purchased is generally illiquid. This means it will be harder to ‘exit or remove the original capital from the company.

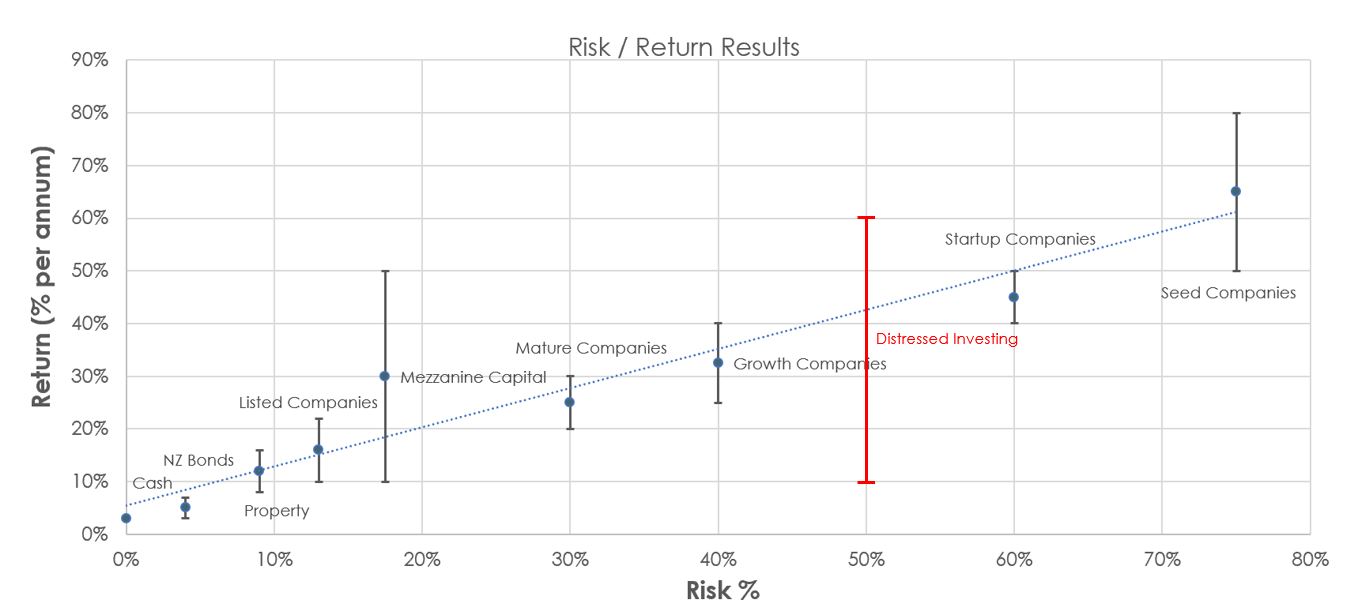

Distressed investing exemplifies the idea of “the bigger the risk, the bigger the reward”, as you can see from its positioning on the risk-return graph below:

High Returns

Despite its inherent risky nature, distressed investing can generate above average returns. Investing in companies in distress is an alternative type of investment. As shown on the above graph, traditional investment categories such as cash, bonds and property have the lowest risk and return. On the other hand, alternative investments such as distressed investing, while carrying higher risk compared to cash, bonds and property can deliver greater returns for those skilled in such investing.

Diversification

Another advantage of distressed investing is its lack of correlation with traditional investments. This is beneficial to investors as distressed investing therefore allows the investor to diversify their portfolio and spread their portfolio risk.

Excercising Control

Distressed investing usually comes with a seat at the table (a directorship in the company, or substantial control in its decision making).. By exerting control over the business, the investor can lead it in a direction that better increases the value of their investment.

Giving Back

Distressed investing also provides an investor with a real/substantial way of supporting local businesses. Recent lockdowns and social distancing measures have resulted in many businesses having to close, restructure, let go of staff or change their offerings. Companies in the tourism, retail and hospitality sectors have been impacted especially hard. Across New Zealand many companies are finding it difficult to stay solvent and this provides investors with much opportunity to help these businesses turnaround or pivot and generate good returns for their portfolio.

Benefits to New Zealand

Investing in local businesses has flow-on effects that benefit New Zealand at large. By investing in New Zealand opportunities, you ensure that a large portion (if not all) of the money will be spent in New Zealand on people, services, and products.

Similarly, investing in New Zealand companies directly benefits their employees. As these businesses grow, they create new employment opportunities. This in turn reduces New Zealand’s unemployment rate, can increase the wage rate as demand for labour increases and deliver a wealth effect.

Supporting the growth and expansion of New Zealand businesses can boost competition and innovation in the industry. Kiwi consumers can benefit from this greater competition, as usually this leads to better value through improved quality, diverse product offerings and a wider range of choice.

For more information on investing in New Zealand see Investing in New Zealand

Boosting Our Economy

At the end of the day, by investing in New Zealand businesses you’re giving back to or supporting our economy. The end goal is investors pooling their resources together to create a prosperous, vibrant and sustainable economy, which is needed during these unprecedented times. Such investment will give our economy the push it needs to climb back up the world rankings in terms of productivity and GDP per capita. Furthermore, distressed investing may also reduce the social burden carried by the government meaning they can deploy the extra funds into better services and infrastructure.

Because this area of investing can be complex, inexperienced investors should seek the help and expertise of their financial advisors. If you’re interested in distressed investing, please get in touch!

Post Tags: